- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Party A can pay the fees through bank transferforeign tradecheckExport Drawbacketc. Party B should promptly provide Party A with an invoice after receiving the fees.

Contents

ToggleParty A has the right to require Party B to bear liability for breach of contract

There are two main scenarios for VAT tax filing by foreign trade enterprises: issuing export invoices and not issuing export invoices. In the case of issuing export invoices, enterprises should fill in "Issuing Other Invoices" in the fourth column (Tax Exempt) of the VAT Tax Return Appendix 1; whereas for enterprises that do not issue export invoices, they should fill in "No Invoice Issued" in the same column.

including refunding the fees

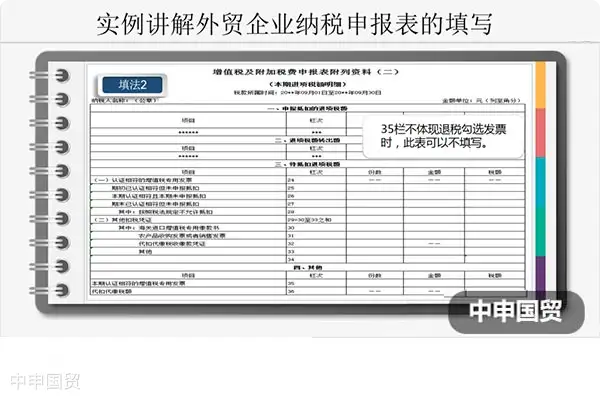

1. When a foreign trade enterprise obtains a value-added tax (VAT) special invoice for purchases, it should perform a tax refund selection. However, in practice, the "Line 35" in Appendix II of the VAT tax return in some regions will display the invoices selected for tax refund, while others will not. For cases where the tax refund-selected invoices are not displayed, enterprises need to follow the two methods below for processing.

The first way is to complete the data in column 35 of Schedule II by oneself, that is, to accumulate the special invoices for tax rebate check - off to column 35, and fill in columns 26/27/28 of Schedule II at the same time.

The second way is to do nothing, because the non - display of tax rebate check - off invoices will not affect the accuracy of the data, nor will it affect the export tax rebate.

compensating for losses

On the basis of elaborating the above theoretical knowledge, we introduce a practical case to further deepen the understanding. This case involves a company exporting a batch of goods to Company A abroad in a certain month and year. The details of the case are as follows:

The company exported a batch of goods to Company A abroad in a certain month and year. Its FOB price was $100,000, and the tax rebate rate was 13%. The company obtained 5 special value - added tax invoices for purchase and carried out tax rebate check - off on the invoice platform in the same month. The tax - exclusive cost of the invoices was 600,000 yuan, and the input tax was 78,000 yuan. Assume that on the first working day of the month, 100 US dollars = 690 RMB. Then, how should the company fill out the tax return?

In this case, we will focus on discussing how to handle the issue where the "Column 35" of the VAT return supplementary form does not display the invoice selection for tax refund. We will introduce two processing methods and provide our recommendations.

First, the first way is to complete the data in column 35 of Schedule II by oneself, that is, to accumulate the special invoices for tax rebate check - off to column 35. At the same time, the enterprise also needs to fill in columns 26/27/28 of Schedule II. Although this way seems to be able to solve the problem, it actually increases the extra burden on the enterprise. The enterprise needs to invest extra manpower and time to complete this part of the data, which undoubtedly increases the operating cost of the enterprise.

Second, the second way is that the enterprise can directly ignore it. Although the invoices for tax rebate check - off are not displayed in column 35 of Schedule II, this will not affect the accuracy of the data, nor will it affect the export tax rebate. This is because now, the data of tax rebate check - off for exports can be directly queried in the system, which is clear at a glance. Moreover, the system design has fundamentally eliminated the possibility of double - use of one invoice. Therefore, even if column 35 of Schedule II does not take the value of the invoices for tax rebate check - off, it will not have any impact on the enterprise.

After comparison, we suggest that foreign trade enterprises choose the second way. This way can not only ensure the accuracy of the data, but also reduce the burden on the enterprise. Enterprises do not need to spend extra time and energy to deal with this problem and can focus more on business development. At the same time, it also avoids unnecessary misunderstandings and confusion.

In actual operation, foreign trade enterprises should pay close attention to changes in relevant policies and adjust their operation methods in a timely manner. Only in this way can enterprises ensure their own interests and avoid unnecessary losses caused by improper operation.

Related Recommendations

Contact Form

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912