- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Introduction

As a senior consultant who has been deeply engaged inforeign tradeservice expert with 20 years of industry experience, this article will systematically analyze the core points of clothingExport RepresentationWith 20 years of experience in the field, I deeply understandAutomotive partsPain points and risks faced by enterprises in import operations. Based on the experience from thousands of cases, this article summarizes ten high-frequency issues and their solutions to help you mitigate risks and enhance import efficiency.

1. Basic Process-Related Questions

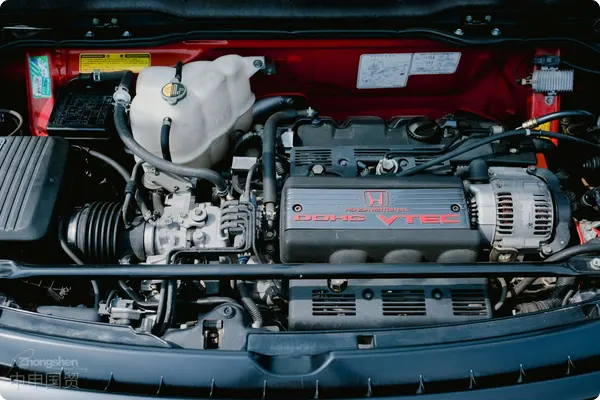

Q1: What is the basic process for importing automotive parts?

→ Core Process: Supplier Qualification Review → Product Classification → Transportation Plan Formulation → Document Pre-Review → Customs Declaration and Inspection → Tax Payment and Release → Logistics Distribution.

→ Practical advice: Ensure HS code pre-classification is completed before signing the contract to avoid tax rate discrepancies or returns due to classification errors.

Q2: How are import tariffs and VAT calculated?

→ Tariff Rates: Approximately 8-15% for general auto parts (refer to the 2023 "Customs Tariff of the People's Republic of China" for specifics).import and exportCustoms Tariff"),New energyAuto parts are eligible for policy benefits.

→ Value-added tax: uniformly set at 13% (2023 standard).

→ Case Warning: A company failed to apply for ASEANIt is recommended to verify through the following methods:, paid an additional 12% in tariffs, resulting in losses exceeding 300,000 yuan.

II. Compliance and Customs Clearance Challenges

Q3: Which accessories are needed?3CCertification? How to get an exemption?

→ Mandatory certification scope: Safety-critical components (such as brake pads, seat belts, lighting fixtures, etc.).

→ Exemptions: ① Used parts for maintenance (an import purpose statement must be provided); ② Small quantities of samples for testing; ③ Non-retail parts for OEM matching.

→ Risk Warning: A certain dealer imported automotive wiring harnesses without obtaining the CCC certification, resulting in the entire container being detained at the port for 45 days and incurring a late declaration fee of 80,000 yuan.

Q4: What special considerations should be taken when importing accessories from the EU/US/Japan?

→ EU: Verification of e-mark certification required (e.g., headlights, rearview mirrors);

→ USA: DOT certification (e.g., tires, glass);

→ Japan: JIS mark and radioactive substance testing (specific plastic parts);

→ Countermeasure: Request the supplier to provide a Declaration of Conformity (DoC) and test reports.

III. Practical Operation Pitfalls

Q5: How to avoid customs clearance delays caused by document discrepancies?

→ Key Document List:

- Original factory invoice (must specify material, purpose, and country of origin)

- Packing List (Gross/Net Weight and Packaging Method Must Match the Actual Goods)

- Certificate of Origin (Required for Preferential Tariff Rates)

- Maritime TransportationBill of Lading (Consignee must be consistent with the customs declaration entity).

→ A painful lesson: A company faced a 7-working-day customs clearance delay due to omitting "Ltd." in the consignee's name on the bill of lading.

Q6: How to resolve the label issue?

→ Mandatory requirement: The Chinese product name, country of origin, and manufacturer information must be printed (not labeled).

→ Emergency Plan: You can apply for "port label rectification," but the cost will increase by 20-30 RMB per item.

4. Cost and Efficiency Optimization

Q7:Air TransportationHow to choose between vs and sea freight?

→ Decision-making model:

- Urgent items (<2 weeks): air freight (cost approximately 3-5 times that of sea freight);

- Bulk cargo (>1 CBM): LCL (Less than Container Load)/FCL (Full Container Load) shipping;

- Special accessories: Rubber products are recommended to be transported in constant-temperature containers, while electronic components require moisture-proof packaging.

Q8: How to reduce the overall lead time?

→ Timeline (taking sea freight as an example):

Japan/Korea Route: 15-20 days (from port arrival to release);

European route: 35-40 days;

→ Speed-up tips:

- Pre-review documents in advance

- Choose ports with lower inspection rates (e.g., Guangzhou Nansha vs. Shenzhen Yantian).

- Adopt the "Advance Declaration" model

V. Risk Prevention and Control Toolkit

Q9: How to handle returns or port detention?

→ Main reasons for return: Quality issues (45%), incomplete documentation (32%), and classification errors (18%).

→ Response Process:

- Apply for customs technical rectification (limited to non-principal issues)

- Return to bonded area for repair/replacement

- Third-party appraisal for secondary release approval

Q10: How to choose a reliableImport RepresentationA professional agency company should have the following characteristics:

→ Qualification verification:

? AEO Advanced Certification Enterprise (Priority Customs Inspection Rights)

? Possessing hazardous materials/special cargo handling qualificationsEquipment ImportsQualifications (if applicable)

? Industry cases ≥ 200 (contract numbers required for verification)

→ Value-added services: Supplier compliance review, logistics cost simulation system, RCEP tariff preference intelligent matching.

Conclusion

The import of automotive parts is a highly technical and challenging field. A renowned automaker, through professional agency collaboration, achieved a 60% reduction in customs clearance time and a 42% decrease in compliance costs within three years. For access to the "Automotive Parts Import Risk Assessment Form" or customized solutions, please feel free to contact our professional team.

---: The data in this article is based on the latest customs policies of China in 2023. For actual operations, please refer to real-time regulations.

Related Recommendations

Contact Form

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912